Frequently Asked Questions

How does AI enhance the debt collection process?

AI debt collection software is designed to help teams more effectively and efficiently manage their caseloads. Automate routine processes, streamline workflows, and leverage data-driven insights to optimize customer outreach. This cutting-edge technology supports better customer service as well as increased collections rates.

Outdated legacy software tends to rely on costly, time-consuming, and error-prone manual processing. On the other hand, AI-native solutions automate routine tasks to improve employee morale and reduce the overall workload. Send reminders, process payments, and so much more. The time saved through automation helps teams refocus their efforts on complex cases.

Additionally, modern AI debt collection solutions leverage AI-powered predictive analytics to optimize their decision-making skills. These tools identify high-risk accounts, assess customers’ ability to self-cure, and adjust outreach strategies accordingly for the best results.

Deliver personalized payment plans tailored to each customers’ unique situation. AI supports the humanized care your customers expect. Understand their history and behavior and optimize communication strategies to boost engagement and response rates. Build loyalty through a more customer-centric approach.

What are the key features of your AI debt collection software?

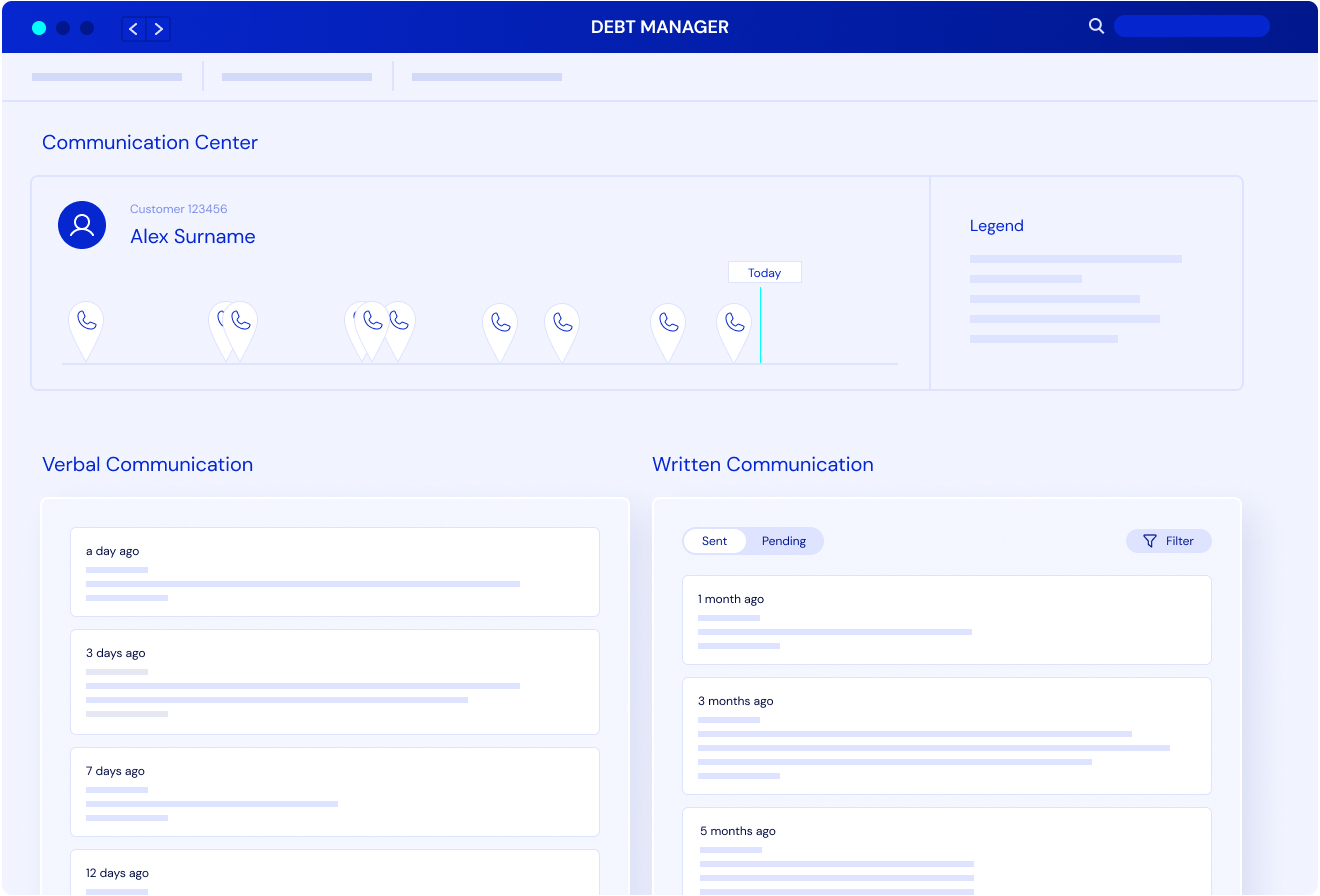

Debt Manager is an AI-native SaaS solution leveraging the latest analytics and algorithms to enhance collections outcomes. Developed over 40 years of comprehensive industry experience, it’s designed to simplify the complex world of debt collections with intuitive interfaces built for technical and non-technical teams alike. Its key features include:

- Automated workflows: Automate business logic faster and drive account progression, using strategic decisioning and configurability to quickly react to changing circumstances. Segmentation rules and context-sensitive user experiences provide customers with a personalized experience to improve outcomes.

- Advanced rules engines: Debt Manager’s world-class user interface facilitates best outcomes for you and your customers. With our AI automated debt collection solution, you gain the power to configure real-time rules and workflows at the customer, case, account, and collateral level.

- Comprehensive configurability: Easily integrate with AI chatbots and other communications systems to enhance customer engagement through preferred channels. Send personalized reminders through the right channel at the right times.

- Strict regulatory compliance: Our AI-powered debt collection solutions are PA-DSS & PCI-DSS Certified to ensure customer data is safe and secure. Plus, you can leverage its AI capabilities to monitor interactions in real time for compliance with regulations like the Fair Debt Collection Practices Act (FDCPA) and General Data Protection Regulation (GDPR).

- Scalable SaaS: Say goodbye to tedious manual processing and high maintenance costs. Unlike outdated legacy systems, SaaS solutions are always up to date. Take advantage of industry-leading flexibility, scalability, and configurability through a platform designed to grow alongside your company. Handle peak volumes with ease and scale on-demand.

Taken together, these features improve the collections process for teams and their customers alike. Reduce the workload, ease the stress on team members, and redirect their efforts towards higher-value projects. More empathetic interactions with customers increase loyalty, satisfaction, and collections rates.

How does AI improve the customer experience in debt collection?

AI technology supports a more humanized approach to collections. It can’t replace a collections team—but it can certainly enhance their existing capabilities. These AI debt collection tools act as superpowered assistants to experienced professionals by automating routine processes, boosting efficiencies, and performing real-time regulatory monitoring. They’ll help reduce instances of human error while freeing collections to spend more time delivering the compassionate care their customers deserve.

Leverage AI debt collections software to develop a better understanding of your customers’ unique circumstances. Find out whether they’re able to self-cure or adapt payment plans to meet their individual needs. AI analytics inform your outreach strategies, too, so you deliver the most effective messages through the most effective channels. Personalized communication powered by AI boosts customer engagement and satisfaction.

AI automated debt collection tools also support customers through the difficulties of debt collection. Speaking with a team member can be intimidating or embarrassing, especially when dealing with personal matters, and not everyone has the time to wait on the phone. AI improves the customer experience through empowering self-service platforms and 24/7 chatbots designed to answer their concerns any time of day.

Can your AI debt collection software integrate with our existing systems?

Yes, our AI debt collection solutions are designed with an open architecture, so they seamlessly integrate with existing systems. Our low-code/no code approach means you can easily take advantage of institutional data to deliver a seamless customer experience across systems, teams, departments, and agencies alike. Not only does this reduce the stress on collections teams, but it also delivers a more satisfying customer experience.

Our SaaS AI debt collection solutions are fast to implement, too, offering rapid time to value, ease of integration, and the elasticity needed to scale on-demand while managing peak volumes. Eliminate the time and stress of overhauling existing processes, and reduce the hefty maintenance and operating costs tied to outdated legacy software. Debt Manager brings collections teams into the future of credit risk management.